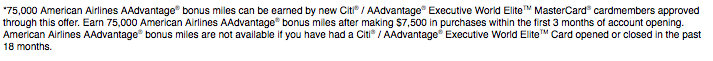

After way too much dithering, I jumped on the 100,000 mile Citi AAdvantage Executive offer last year. I’m so glad I did, and it’s not just about the miles – more on that in a minute. The top of the line Citi AAdvantage card is now offering a 75,000 mile bonus when you spend $7,500 in the first 3 months. Not quite 100,000, but respectable nonetheless. The annual fee remains at $450. There’s another difference in this offer and some that have existed previously as Miles to Memories pointed out earlier.

The bonus miles are not available if you’ve had a Citi AAdvantage Executive card opened or closed in the past 18 months. This knocks out those of us who played in the 100K bonanza last year. I’ve really ratcheted back my credit card game and I’m not in the market for new cards right now, but this will keep a large number of people who aren’t laying low from participating in this offer since so many in the hobby were in on the 100K deal.

Why I Think This is a Good Card

75,000 AAdvantage miles aside, the card has a compelling portfolio of benefits for any well-traveled person that flies American Airlines on a routine basis.

- Admirals Club® Membership

- Elite Qualifying Miles

- Global Entry or TSA PreCheck application fee credit

- No Foreign Transaction Fees on Purchases

- Earn 2 AAdvantage® miles for every $1 you spend on eligible American Airlines and US Airways purchases

- Enhanced Airport Experience

- First Checked Bag Free on Domestic Itineraries

- 25% savings on eligible in-flight purchases on American Airlines and US Airways flights

- No Mileage Cap

- Expert Concierge Service

Those are the marketing bullets, but if you’re buying an Admirals Club® membership anyway, you may find this card to be the best deal or at least as good as any for club membership. Frankly, I find myself using the club membership more than I expected, even when I’m not flying American. The Global Entry or TSA PreCheck fee credits can make up the difference in fees for those eligible for elite discount memberships in the club plus you can earn 10,000 elite qualifying miles for $40K in charges each year.

There are other benefits that do not get as much attention, but I would point to the travel cancellation and interruption insurance benefit provide with the card as being among the better out there. It covers up to $5,000 per person, and unlike the Chase Sapphire Preferred card’s protection, I cannot find a pre-exitsting condition exclusion provision in the coverage documentation. That’s not my primary consideration in choosing a credit card, but it is something to think about, especially for me.

So, if you’re in a position to take advantage (no pun intended) of this offer, give this card a strong look. It comes with a decent set of benefits, and the miles might just be gravy.

Click here to check out this offer.

-MJ, July 1, 2015

[…] 75,000 AAdvantage Miles – Citi Executive Card […]

As a small business owner who makes a lot of purchases in the daily operation of my business offers like this are perfect for me. $7.5 no issues in a month. $10K too. The Chase $1K spends are almost too small but I will take them. Alas I’m not eligible for this one because I too jumped on the 100K for $10K last year.

That would be a lift for me in the absence of innovative spending strategies. 🙂

I wish they’d drop the minimum spend to something reasonable. The previous version of $5k in 3 months was impossible for me. Are they going to make the standard offer $10K in 3 months next?